JOBS REPORT: U.S. payrolls jump by 266,000, smashing expectations

The U.S. economy added far more jobs than expected in November and the joblessness rate edged down to a 50-year low, as the domestic labor market continued to fire on all cylinders.

The Department of Labor delivered its November jobs report at 8:30 a.m. ET Friday. Here were the main results from the report, compared to consensus data compiled by Bloomberg:

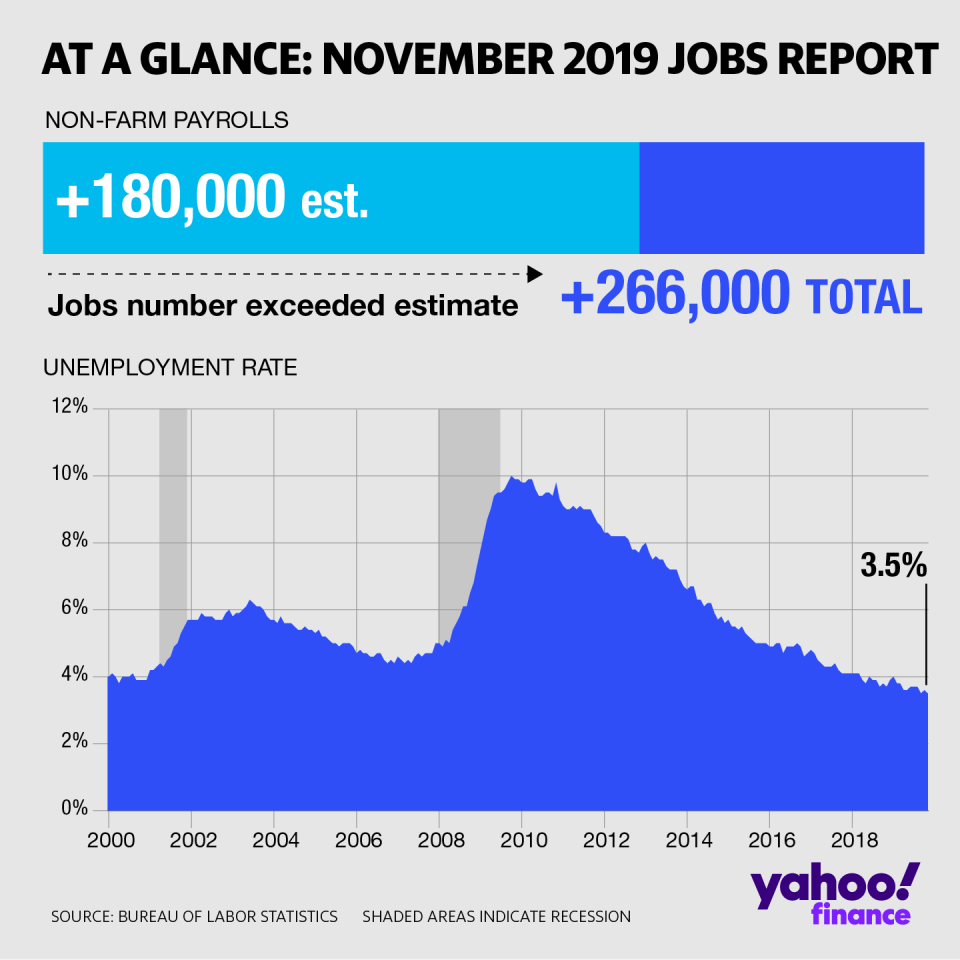

Change in non-farm payrolls: +266,000 vs. +180,000 expected and +156,000 in October

Unemployment rate: 3.5% vs. 3.6% expected and 3.6% in October

Average hourly earnings month over month: +0.2% vs. +0.3% expected and +0.4% in October

Average hourly earnings year over year: +3.1% vs. +3.0% expected and +3.2% in October

The latest jobs report also included upward revisions to both September’s and October’s headline payroll figures. September’s change in total non-farm payrolls was revised up by 13,000 to 193,000, while October’s level was revised up by 28,000 to 156,000. These updates raised the three-month average of job gains to 205,000.

At just 3.5%, the November unemployment rate matched September’s level for the lowest since 1969. The total labor force participation was nearly unchanged at 63.2%, just a hair below October’s 63.3%, which had reflected the largest share of the working population employed or looking for work since 2013.

Stock futures added to gains in early trading following the estimates-topping report, with the Dow up more than 150 points. Treasury yields surged, and gold prices fell as investors piled into risk assets.

“Along with the upward revisions to earlier months, these numbers are telling us that job growth in the U.S. has stabilized,” Brian Coulton, chief economist at Fitch Ratings, wrote in an email Friday. “This highlights that conditions remain firmly in place for the consumer and the service sector to cushion the economy from external risks and related weakness in U.S. manufacturing.”

Heading into the report, consensus economists expected that headline employment gains would get a boost from the return of thousands of General Motors (GM) workers, after a 40-day United Auto Workers strike contributed to a net decline of 43,000 manufacturing payrolls in October, revised from a loss of 36,000 previously reported.

In November, the manufacturing sector added 54,000 positions, topping expectations for 40,000 and “reflecting the return of workers from a strike,” the Bureau of Labor Statistics wrote in its report. Motor vehicles and parts industries added 41,300 jobs during the month, just about reversing the decline of 42,800 from October.

But strength in the November jobs report was broad-based, even outside of the one-time impact of the strike’s abatement.

The private sector on the whole added 254,000 positions during the month, well above the 178,000 expected and 163,000 added in October. This result contrasted sharply with the weaker than expected results of ADP/Moody’s report on private sector employment published earlier this week, though many economists had pointed out that the survey serves as an imperfect indicator of the Department of Labor’s jobs report.

Education and health services industries added 74,000 jobs during the month, more than double these industries’ additions from the month prior. Business services and leisure also saw strong gains, adding 38,000 and 45,000 positions, respectively, during the month.

Only two industries saw job losses during the month, and even these were relatively sanguine. Mining and logging industries lost 7,000 positions in November, while wholesale trade industries lost 4,300. That said, job gains slowed considerably for retail trade heading into the holiday season, with just 2,000 new jobs added in November after 22,000 additons in October.

Consensus economists held high expectations for the November jobs report as other economic indicators of U.S. employment held firm during the month.

IHS Markit’s print on manufacturing sector activity last week registered the fastest rise in employment since March, and the firm’s service sector report showed the first rise in service sector employment growth in three months.

The Institute for Supply Management’s non-manufacturing employment index increased in November to the highest level since July, although the manufacturing employment index decreased slightly. Initial jobless claims remained relatively low throughout November and unexpectedly fell to the lowest level in seven months during the final week of the month (though the BLS survey period takes place during the week of the 12th of the month).

The Department of Labor’s jobs report Friday serves as one of the last pieces of new economic data Federal Reserve members receive before heading into their final interest rate-setting meeting of the year next week.

“As for the Fed, these data should support the ‘on hold’ stance, at least for the time-being,” Rubeela Farooqi, chief U.S. economist for High Frequency Economics, said in an email Friday.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Stock Market 2020: BMO’s bull is reminded of Notorious B.I.G., Tupac and Snoop

How this CBD company created a buzz by ‘kind of making fun of millennial culture’

FedEx CEO: ‘Whistling past the graveyard’ on the U.S. consumer belies a broader slowdown

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news