Strong bank earnings boosted by the American consumer — and heavy buybacks

Strong earnings for the final quarter of 2019 show a healthy bank industry and an even healthier U.S. consumer, although estimate-beating bottom-line earnings also got a generous boost from heavy buyback activity.

“Our results continue to reflect the strength of the U.S. consumer in the biggest economy in the world,” Bank of America (BAC) CEO Brian Moynihan said while kicking off a conference call to report fourth-quarter results on Jan. 15.

JPMorgan Chase (JPM) CEO Jamie Dimon said the U.S. consumer, which represents 70% of the U.S. economy, should remain a bright spot for growth through 2020.

“Our outlook heading into 2020 is constructive, underpinned by the strength of the U.S. consumer,” Dimon said on his company’s earnings call on Jan. 14.

The largest U.S. banks reported earnings for the fourth quarter this week, showing estimate-beating earnings despite challenges on historically low interest rates.

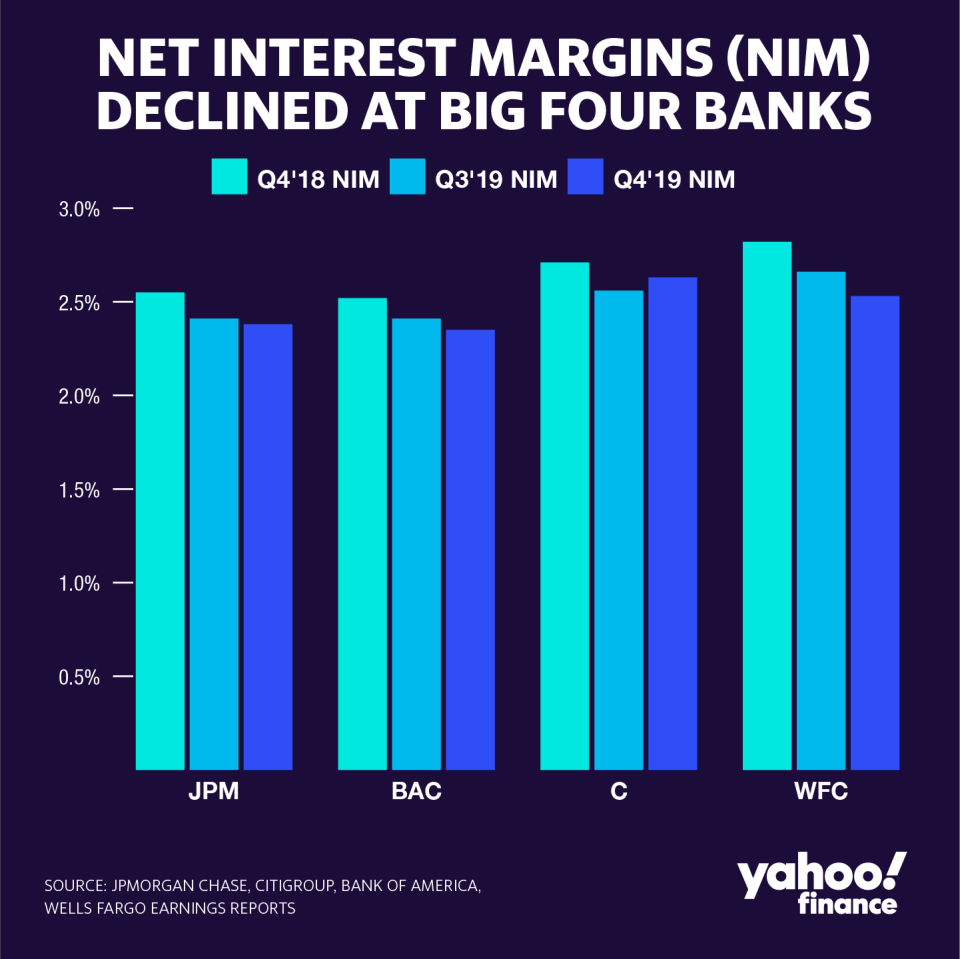

Net interest margin, a measure of the interest collected on loans minus interest paid on deposits, has continued to face pressure despite the Federal Reserve’s three rate cuts in 2019.

Among the four largest American banks, only Citigroup (C) saw a quarter-over-quarter increase in net interest margin, up seven basis points.

Citi CFO Mark Mason told reporters Jan. 14 that with the Fed expected to make little moves on rates in 2020, he still expects a lagged effect of the 75 basis points of interest rate cuts to impact net interest revenue this year.

“What we've assumed from a planning point of view, having looked at multiple scenarios, is more similar to what's in the forward curve right now, which is for one additional more cut in the back end of 2020,” Mason said.

Vining Sparks research analyst Marty Mosby told Yahoo Finance’s The Ticker on Jan. 14 that the “compression in margin is actually slowing,” suggesting brighter days for interest revenue in 2020.

Banks also saw a boost to revenue off of strong year-over-year fixed income trading. Compared to a volatile 2018 that saw fixed income tank among the larger banks, the largest financial firms appeared to see a solid rebound in bond trading revenues.

At Morgan Stanley, revenues from fixed-income, currency and commodities trading grew 126% year-over-year. Its main competitor, Goldman Sachs (GS), reported a 63% year-over-year increase in its FICC revenues.

Buybacks

Most of the banks were able to beat estimates on the bottom line as they delivered large amounts of capital to shareholders.

Buybacks generally help reduce share count and boosts earnings per share figures.

Unlike other industries, the largest U.S. banks have to have their capital return plans approved by regulators. All of the banks passed the Fed’s stress tests in June of last year, green-lighting the big banks up for their plans on buybacks and dividends.

Morgan Stanley (MS) said it was able to buy back its own shares at a nice market discount. Because financials lagged the market for a good chunk of 2019, Morgan Stanley was able to buy back about 100 million net shares when the stock was trading at about $38.

As of market close on Friday, shares of Morgan Stanley were trading at $57.51. The company reported adjusted earnings per share of $1.20, well above the street’s estimates of $1.02.

“That was a little gift that God gave us,” Morgan Stanley CEO James Gorman said Jan. 16.

Not every bank beat estimates. Wells Fargo (WFC), still reeling from its reputational problems, reported operational losses of $1.9 billion in the last quarter of the year as a result of litigation-related costs. The company reported adjusted earnings per share for the fourth-quarter of $0.93, below the street’s estimates of $1.11.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Trump says he'll nominate Shelton, Waller to remaining Federal Reserve board seats

'This is the new normal': California businesses pessimistic on phase 2 deal

Boston Fed President Eric Rosengren speaks with Yahoo Finance [Transcript]

Boston Fed's Rosengren: 'We don't need to do very much at all' on interest rates

‘The weirdest place in the world’: What the Fed missed in Jackson Hole

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.