AT&T Expands 5G FWA Play, Internet Air, to 16 New Cities, Including L.A., Chicago, Philly and Phoenix

AT&T, which is focused on fiber deployment, isn't as serious about the future of fixed wireless access as its wireless peers, Verizon and T-Mobile, are. Those two companies have nearly 6 million FWA customers between them after just two years in the market.

However, after the April soft-launch of its own 5G FWA service, which it calls Internet Air, into DSL markets still using its century-old copper network, AT&T announced the expansion of Internet Air into a dozen more markets on Tuesday.

These new Internet Air regions either haven't had AT&T's fiber deployed to them yet, or they are still fiber-lite and AT&T is filling in gaps with an FWA alternative.

The markets include:

Los Angeles

Chicago

Philadelphia

Las Vegas

Phoenix

Detroit

Pittsburgh

Seattle-Tacoma

Salt Lake City

Cincinnati

Portland, Oregon

Minneapolis-St. Paul

Harrisburg-Lancaster-Lebanon, Penn.

Tampa-St. Petersburg, Florida

Flint-Saginaw-Bay City, Michigan

Hartford-New Haven, Conn.

AT&T is offering Internet Air for $55 a month plus taxes, while guaranteeing no price increase for a year.

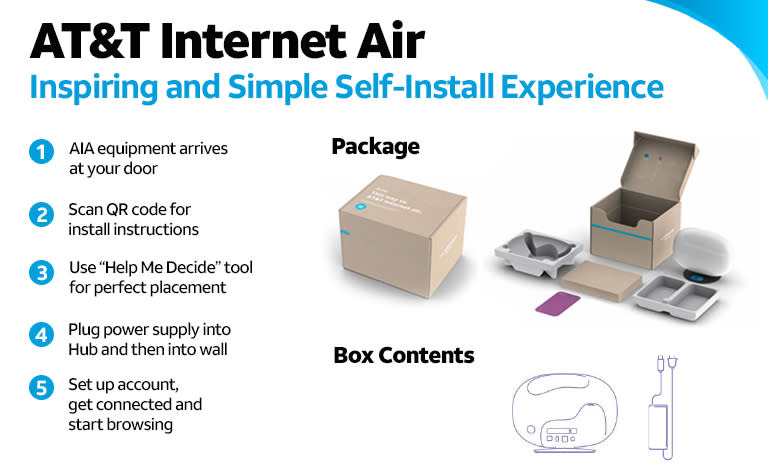

The telecom is also promising now fees, hidden or otherwise, and an easy self-install customer experience.

Speaking 11 months ago at the Bank of America Media, Communications and Entertainment Conference, AT&T CFO Pascal Desroches made clear AT&T's wireline broadband priorities, which put fiber at the top.

“Long term, we don’t believe it will be good enough,” Desroches said of FWA, which delivers download speeds ranging between 40 Mbps - 140 Mbps. “And that’s why we think it is really important to start to place our bets now with fiber because by the time fiber becomes the only acceptable solution, it will be too late to start to build out because of the long lead times.”

With an estimated 6.2 million AT&T broadband customers still on copper DSL, 5G FWA "makes sense" as an alternative, Desroches added, until fiber can reach these customers, or if they're in rural places in which fiber won't be deployed to them.

"We keep the customer and then ultimately transition them to fiber," he explained.