Renting an apartment? Rents during COVID are already high and they are only going higher

In April, when Carley Siglin started calling rental agencies in Boise, Idaho, her calls were mostly not returned.

When property managers did call back, she was told the apartments had already been rented or she would have to get on a waitlist.

By June, the Rochester, New York, resident was getting desperate. Her husband was about to begin medical school in the Boise area and the couple and their young child still didn’t have a place to stay.

Meanwhile, the steadily rising rents in Boise were a constant worry.

“I was working a full-time job but still couldn’t qualify for a two-bedroom apartment,” said Siglin, who was looking for an apartment in the range of $1,200.

►When showing becomes stressful: Climate change shapes where Americans relocate

►Can 'love letters' from home buyers perpetuate racism? This state thinks so

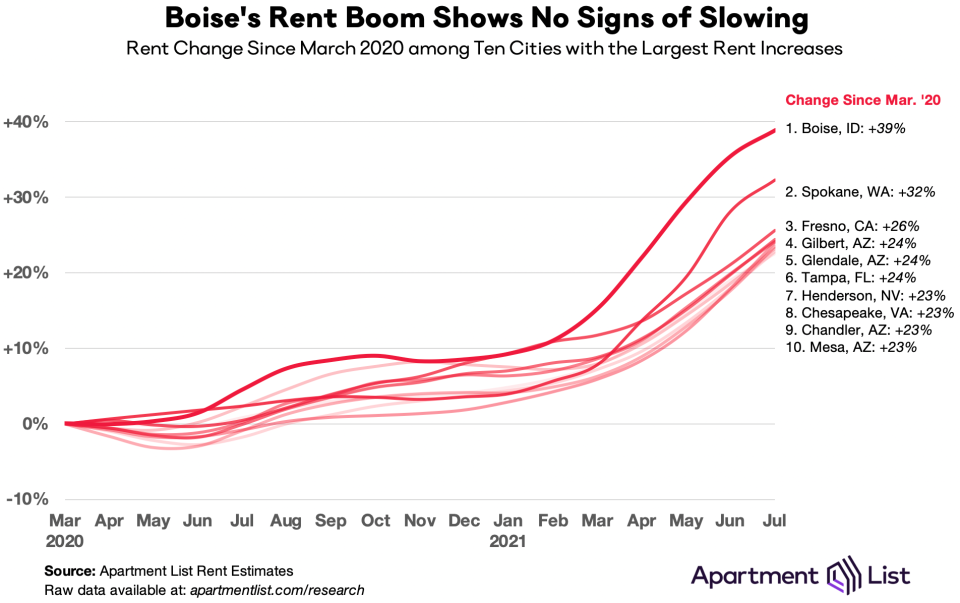

Rent prices in Boise are up 39% since last March, growing at a faster rate than any other metro area in the nation over the past year, according to data from Apartment List, an online rental marketplace.

Boise is not alone. Soaring rents are now increasingly a fact of life across the country, squeezing household budgets and ratcheting up financial pressures on renters.

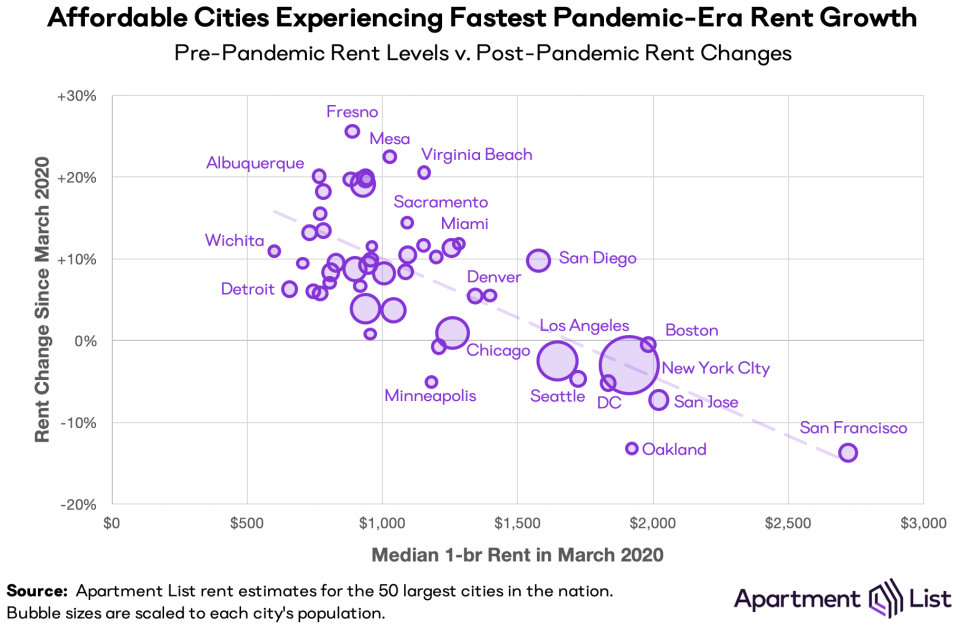

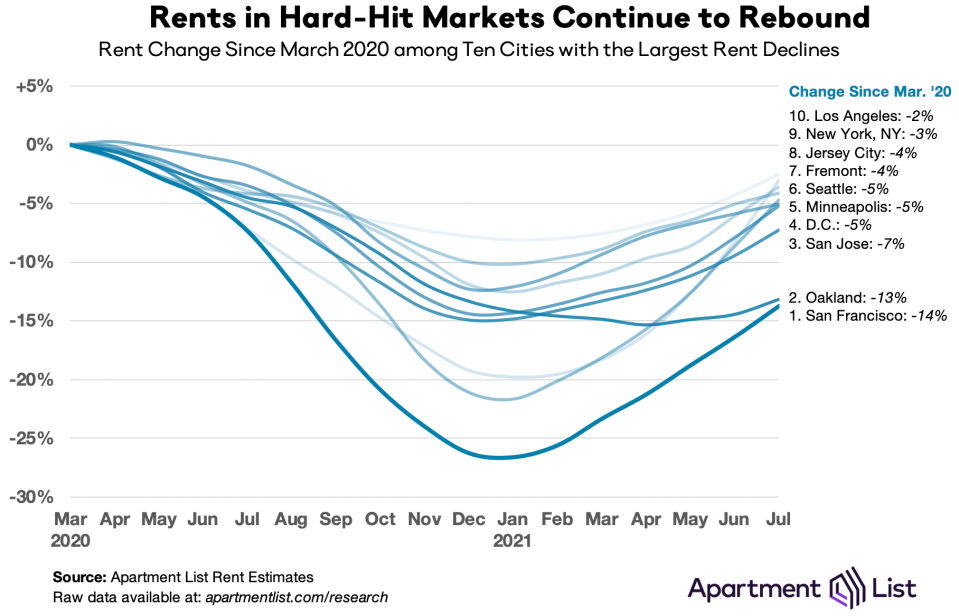

COVID-19 has only made the problem worse, with a growing number of individuals and families fleeing coastal cities. While rents declined in San Francisco and Manhattan, the long lines of moving trucks into midsized markets drove up prices as Californians and New Yorkers streaming into smaller cities and suburbs brought their big city housing crisis with them.

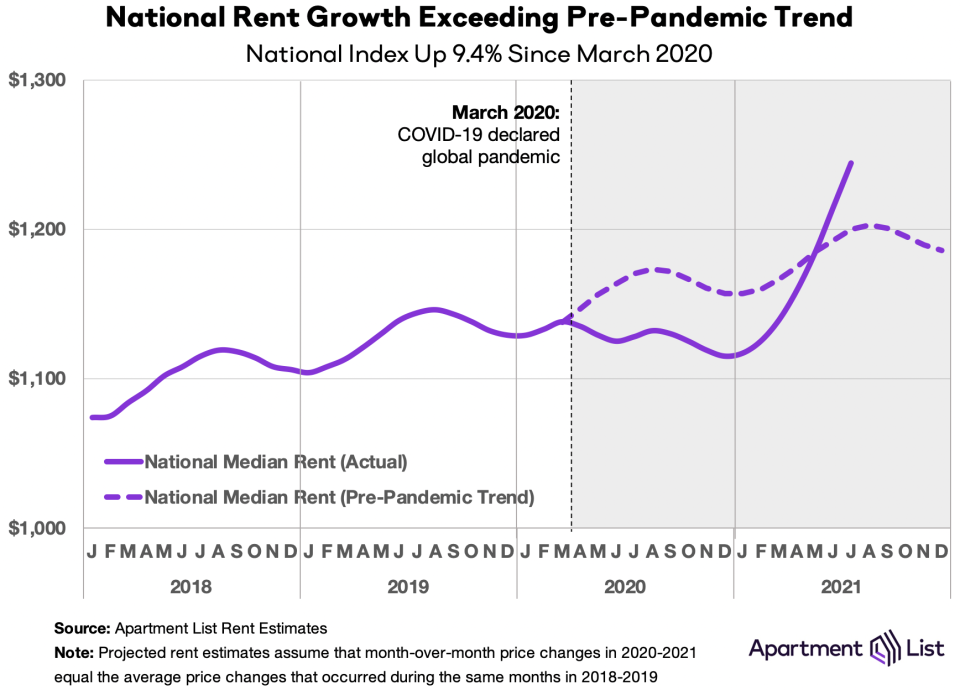

This year alone, the national median rent has increased by 11.4%. In the pre-pandemic years from 2017 to 2019, rent growth from January to July averaged 3.3%. Prices are up 10.3% compared to this time last year and 9.4% compared to pre-pandemic levels from March 2020.

In July, days before her husband would start medical school, Siglin finally got lucky when a local contact put her in touch with a management company that doesn't advertise online.

“So it's kind of who you know type of basis that we were able to finally get something,” she said. Plus, the contact, a longtime Boise resident, agreed to serve as a guarantor.

Even as the pandemic showed signs of easing its grip, pricey markets, such as New York and Seattle have begun to rebound. But there's still no relief in sight for cities where rents have been growing fastest, such as Boise and Spokane, which are continuing to boom, a newly released national rent report by Apartment List found.

Kevin Hawk, a native Idahoan whose connection to Boise goes back generations, is used to seeing people from California, Washington and Oregon flock to the Treasure Valley region (made up of cities including Boise, Meridian, Nampa and Eagle) in recent years.

But never this many.

When the pandemic hit, people who could work remotely fled dense and expensive urban areas in search of affordable options with more space, good schools, easy access to the outdoors and a better quality of life, spurring a sharp rise in rental prices.

“We have a lot of first-time renters here in the marketplace. There are a lot of people that own in the coastal cities who don't want to buy right away,” said Hawk, a co-founder of 208.properties, a real estate and property management company in Boise. “They want to rent for six or 12 months, whether they're waiting for their house to get built, or they want to get the lay of the land.”

The national median rent currently stands at $1,244, $44 more a month than it would have been had rental prices had not jumped with the influx of out-of-towners.

“At a moment like this where the economy is heating up very quickly, the demand can move much more quickly than we can build new homes, especially at a time where construction is meeting labor and material shortages,” said Igor Popov, the chief economist at Apartment List. “So price is really what's trying to balance the market and we've just seen skyrocketing rents throughout the course of the year.”

One of the factors contributing to growing demand is the expansion of the number of households, Popov said. There are now 3 million more households in the U.S. than a year ago, and 1 million more compared to 2019, according to the Current Population Survey of the U.S. Census.

“One of the things we saw during the pandemic was households banding together. People were struggling. Young adults were back in with their parents at record rates,” Popov said. “But now we are seeing that trend reverse.”

Renters say rent increases mean they'll never save enough to buy a home

Some renters fear they'll never save up enough to become homeowners.

When Sarah and Caleb Pflugrath got engaged in January, they immediately started looking for apartments in the Boise-Meridian area, where Sarah grew up.

"It was really hard," said nursing student Sarah Pflugrath.

Most places would be taken quickly or had multiple applications. The rents seemed to go up every month.

Six months later, they finally decided to look 30 minutes away in Caldwell, where rents were cheaper. It was an apartment they had seen before, but the price had jumped $200 in six months and was more than most mortgages.

"We're paying $1,100 for a one-bedroom and it is outrageous, but we don’t make enough to buy a house in this market either," she said. "It’s insane. We are not saving anything. It makes me think we’ll never be able to afford our own home."

►Two Americas: Buy a house during COVID-19? The housing market is a tale of two Americas and first-time buyers are struggling

Lack of inventory contributing to tight housing market

A tight housing market, defined by a lack of inventory and double-digit price growth in metro areas, is also playing a big part in rental prices going up, experts say.

Housing analyst Logan Mohtashami says millennials, specifically those between the ages of 27-33 who are in their prime homebuying years, are also being shut out by high prices.

“They are about 32.5 million strong and make up the biggest demographic patch ever recorded,” said Mohtashami. “Not everyone can buy a house, but everyone needs shelter." So prices will go up with the growing demand, he said.

Rents remain below pre-pandemic levels in just 13 of the nation’s 100 largest cities, and even in these markets, prices are rebounding quickly. San Francisco experienced a 27% drop in rents from March 2020 through January 2021, but since January, rents in the city have increased by over 17%. Rents in Boston, Seattle and New York have gone up by more than 20% in the same time period.

Some landlords blame national eviction moratorium

The national eviction moratorium has kept some lower priced rental units from becoming available, says Dean Baker, chief economist at Center for Economic and Policy Research.

“These units are not necessarily at the bottom end of the market,” Baker said. “But my guess is the vast majority of units where people are facing eviction are in the bottom quartile of the market.”

In Spokane, Washington, rents went up by 29.5% June over June. Keith Kelley, an owner and property manager of several rental units, blamed the rent increase on a significant jump in the cost of repairs and higher taxes.

The eviction moratorium often resulted in nonpayment of rents. The city also instituted a ban on rent increases for about a year during COVID.

“The rents have been suppressed artificially by our government. And then there is an enormous lack of housing supply,” said Kelley. "So just based on supply and demand alone, landlords have the ironic privilege to charge more rent and hold out for tenants who don't have any negative marks on their record, for example.”

That's a fear that haunts Siglin, who moved in July from Rochester to Meridian, about 12 miles from Boise.

“We're kind of at the mercy of the landlords because they could substantially increase the rent. And that makes me concerned,” she said. “I don't want to be kicked out of our apartment because we can't afford the rent that the landlords keep jacking up.”

Swapna Venugopal Ramaswamy is the housing and economy reporter for USA TODAY. Follow her on Twitter @SwapnaVenugopal

This article originally appeared on USA TODAY: Rent prices are high and increasing as markets rebound from COVID