Options Traders Speculate on Surging Tesla Competitor

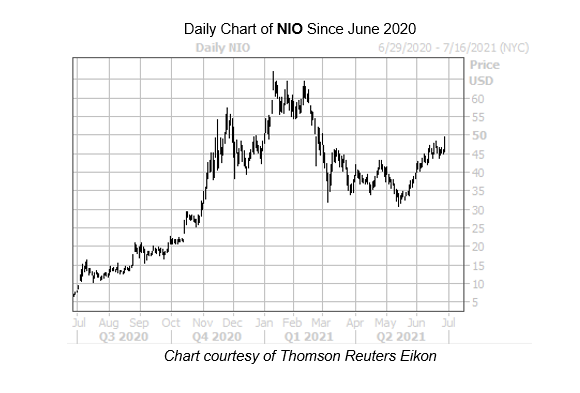

China-based electric vehicle manufacturer Nio Inc (NYSE:NIO) is one of the best performing stocks on the New York Stock Exchange today. At last check, the security is up 8.7% at $49.01, eyeing its highest close since March 1. NIO boasts a 26.9% lead over the last month and a 609.7% year-to-date gain. Options traders have been taking notice of the Tesla (TSLA) competitor as a result.

In response to today's price action, 310,000 calls and 111,000 puts have crossed the tape, which is nearly double the average intraday volume. Most popular is the weekly 7/2 50-strike put, followed by the 48-strike call from the same series, with positions being opened at both.

Calls have been the popular choice of late, per Nio stock's 10-day call/put volume ratio of 3.28 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio stands higher than 79% of readings from the past year, suggesting calls are being picked up at a quicker-than-usual rate.

These traders have picked an opportune time to speculate on NIO with options, as premiums can be had for a bargain at the moment. The equity's Schaeffer's Volatility Index (SVI) of 55% is higher than just 2% of readings from the last 12 months, indicating that the options market is pricing in relatively low volatility expectations right now.

Plus, Nio stock's Schaeffer's Volatility Scorecard (SVS) sits at 100 out of a possible 100. This means the security has managed to exceed volatility expectations during the past year -- a boon for option buyers.