Luxury Is Heading Toward a Post-Euphoria Phase

After gorging on luxury goods amid post-COVID-19 euphoria, consumers are likely to “sober up,” causing growth to moderate and returning the sector to its cyclical pattern.

Still, prospects remain positive thanks to both elite and entry-level customers, with mega brands best positioned to capture different segments.

More from WWD

So argues Bernstein analyst Luca Solca in a report published Thursday on the “luxury goods consumer of the future.”

It estimates that the top 5 percent of clients account for more than 40 percent of sales for most luxury goods brands, with the bottom 50 percent of customers generating about 15 percent of revenues.

“Rising income and wealth inequality are boosting spending power at the top of the social pyramid,” according to the report.

Solca noted that “the modern luxury goods industry has become far sharper in the past 10 years in reconnecting with consumers at the top via limited editions, VIP facilities and events in a seemingly boundless escalation.”

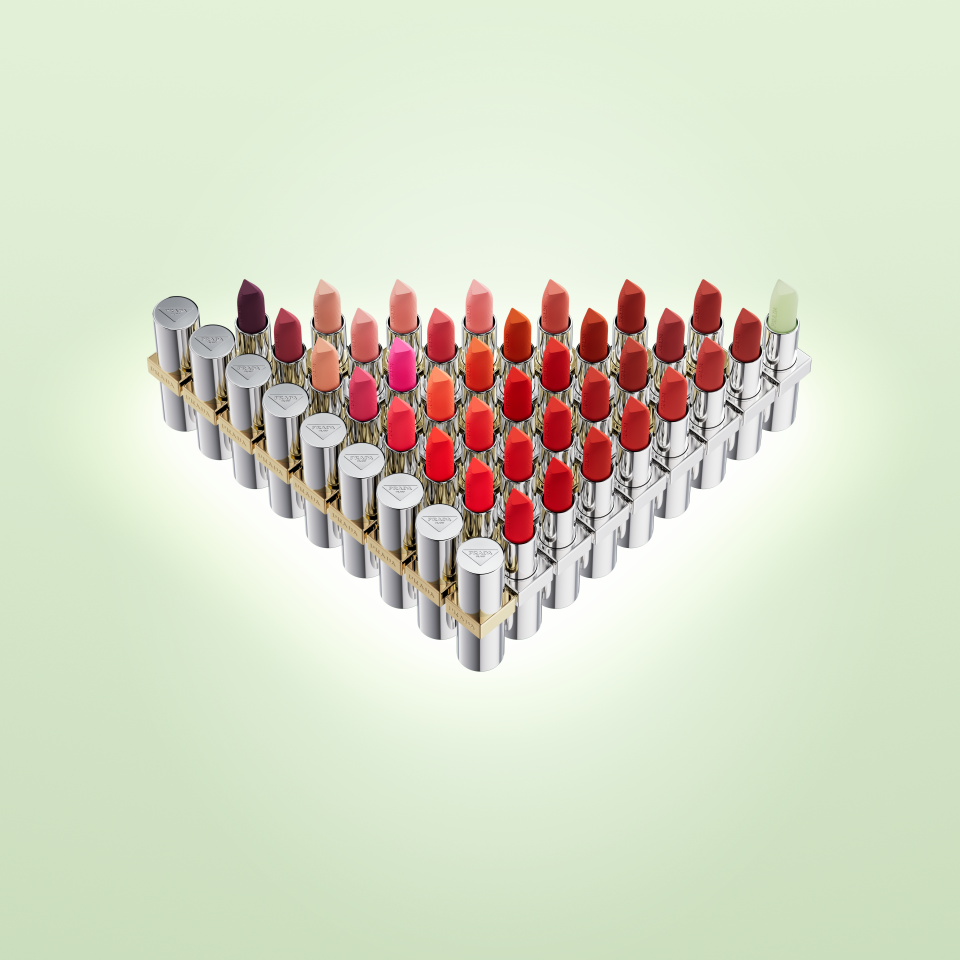

At the other end of the spectrum, luxury’s mega brands have expanded offerings in lower-price categories including beauty products, footwear, belts, T-shirts, costume jewelry and sunglasses, giving them access to a larger number of clients.

In Solca’s view, the appetite for luxury goods is becoming universal. “We live in an era of individual rights and self entitlement. Luxury brands and the support they provide to our idealized image of ourselves perfectly fit this zeitgeist,” he writes.

Luxury’s biggest players seem best positioned to penetrate a broadening middle class via category segregation that helps them “maintain perceived exclusivity.” This extends to retail amenities, with cafés for entry-level customers and private salons to “lavishly host VICs.”

For example, the Dior 30 Montaigne flagship in Paris is organized so that consumers of all levels can participate at different rungs of its “category ladder,” with the general public able to visit its Galerie Dior museum for 12 euros, and high-rollers able to book a private suite and splash out millions of euros during their stay, according to Bernstein.

The report characterizes the American market as a harbinger for the luxury sector’s normalization, with post-pandemic euphoria ebbing after a two-and-a-half-year resurgence, and Chinese consumers picking up the growth relay.

“Other nationalities that abandoned COVID-19 restrictions later are still in YOLO [you only live once] mode — namely the Japanese; even Europeans seem more sanguine than Americans,” it says.

In an interview, Solca noted that luxury spending under normal circumstances depends on consumers feeling better off.

“This happen when economic growth accelerates, asset market prices rise, credit eases,” he explained. “A more or less conscious decision to spend money while one still can — irrespective of where the drivers above stand — is one of the consequences of the pandemic.”

Best of WWD